It all Depends

Financial advisors know that many clients avoid thinking about what happens to their debt after they die. Understanding what type of debt you have is important because your debts may or may not pass on to other people after you die.

Talking to a financial planner or bankruptcy lawyer may help you prepare and avoid problems for what may happen to your debts after your death.

Assessment

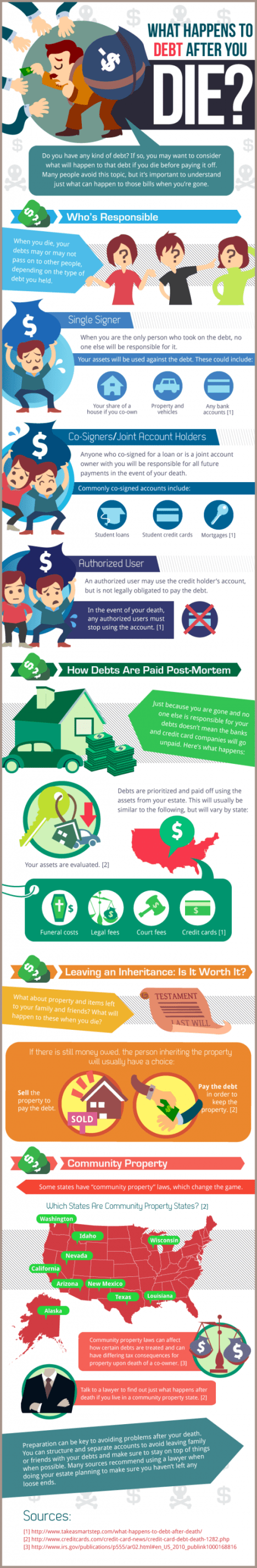

Check out the above visual guide of What Happens to Your Debt after You Die.

Source: totalbankruptcy.com

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

Filed under: Estate Planning, Financial Planning | Tagged: Debt after Death?, Just What Happens to Your Debt After You Die? |

A Video On Digital Death

[What Happens Online When You Die]

What is the future of your digital self? You might not know what happens when you die but you can control what happens online!

You are filling the internet with status updates, image and video creating new digital dilemmas such as:

• Whether you want to live forever online?

• How to protect your privacy after death?

• How to maintain your digital legacy?

• Who to appoint as your digital executor?

• Whether You Would Want to Be Digitally Resurrected

Here is the Video Infographics

Link: http://www.infographicsarchive.com/new-infographic/digital-death-what-happens-online-when-you-die/

Ann Miller RN MHA

LikeLike

Buried by a dead relative’s debt?

Even after death, debts need to be paid, and how that’s done can be a complicated affair, depending on the deceased’s estate.

http://money.msn.com/debt-management/buried-by-a-dead-relatives-debt-bankrate.aspx

And, with aging baby-boomers, this is a hot topic.

Carmine

LikeLike

Living Debt

Debt levels remain high, which means many medical professionals and consumers need to reduce what they owe as a step toward improving their financial well-being.

These strategies can help.

http://money.msn.com/debt-management/escape-the-great-debt-trap-kiplinger.aspx

Ralph

LikeLike

Do Docs Grieve When Their Patients Die?

In the medical profession, such grief is seldom discussed – except, perhaps, as an example of the sort of emotion that a skilled doctor avoids feeling.

But, in a new paper published in the Archives of Internal Medicine, researchers found that not only do doctors experience grief, but the professional taboo on the emotion also has negative consequences for the doctors themselves, as well as for the quality of care they provide.

Dr. Elaine

LikeLike

Fraud, Debt Collection Abuse on Rise, While Alive

Besides a volatile U.S. economy and an unpredictable stock market, consumers now face an increasing number of other ways that they may be parted from their money, according to this new survey.

http://www.fa-mag.com/fa-news/11783–consumer-fraud-and-debt-collection-abuse-on-the-rise-survey-says-.html

James

LikeLike