ME-P SYNDICATIONS:

WSJ.com,

CNN.com,

Forbes.com,

WashingtonPost.com,

BusinessWeek.com,

USNews.com, Reuters.com,

TimeWarnerCable.com,

e-How.com,

News Alloy.com,

and Congress.org

BOARD CERTIFICATION EXAM STUDY GUIDES

Lower Extremity Trauma

[Click on Image to Enlarge]

The “Medical Executive-Post” is about connecting doctors, health care executives and modern consulting advisors. It’s about free-enterprise, business, practice, policy, personal financial planning and wealth building capitalism. We have an attitude that’s independent, outspoken, intelligent and so Next-Gen; often edgy, usually controversial. And, our consultants “got fly”, just like U. Read it! Write it! Post it! “Medical Executive-Post”. Call or email us for your FREE advertising and sales consultation TODAY [770.448.0769]

ePodiatryConsentForms.com

Suite #5901 Wilbanks Drive, Norcross, Georgia, 30092 USA [1.770.448.0769]. Our location is real and we are now virtually enabled to assist new long distance clients and out-of-town colleagues.

If you want the opportunity to work with leading health care industry insiders, innovators and watchers, the “ME-P” may be right for you? We are unbiased and operate at the nexus of theoretical and applied R&D. Collaborate with us and you’ll put your brand in front of a smart & tightly focused demographic; one at the forefront of our emerging healthcare free marketplace of informed and professional “movers and shakers.” Our Ad Rate Card is available upon request [770-448-0769].

“Providing Management, Financial and Business Solutions for Modernity”

Whether you’re a mature CXO, physician or start-up entrepreneur in need of management, financial, HR or business planning information on free markets and competition, the "Medical Executive-Post” is the online place to meet for Capitalism 2.0 collaboration.

Support our online development, and advance our onground research initiatives in free market economics, as we seek to showcase the brightest Next-Gen minds.

THE ME-P DISCLAIMER: Posts, comments and opinions do not necessarily represent iMBA, Inc., but become our property after submission. Copyright © 2006 to-date. iMBA, Inc allows colleges, universities, medical and financial professionals and related clinics, hospitals and non-profit healthcare organizations to distribute our proprietary essays, photos, videos, audios and other documents; etc. However, please review copyright and usage information for each individual asset before submission to us, and/or placement on your publication or web site. Attestation references, citations and/or back-links are required. All other assets are property of the individual copyright holder.

Bringing “Affordability” to the Affordable Care Act

eHealth CEO Gary Lauer has a plan to give individual and family health insurance shoppers the same tax benefits enjoyed by big corporations.

https://www.ehealthinsurance.com/resource-center/about-insurance/bringing-affordability-affordable-care-act?allid=Tab44506&sid=h1p1&utm_source=taboola&utm_medium=referral

Doing so could finally help bring affordability to the Affordable Care Act.

Hope Hetico RN MHA

LikeLike

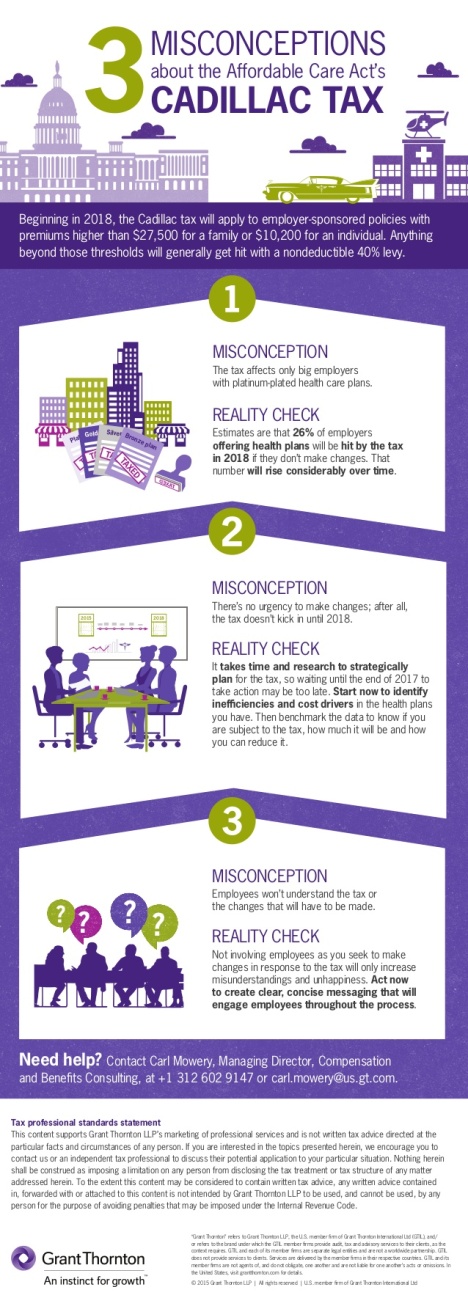

Has the Cadillac Tax Hit a Dead End?

The delay of the tax on high-end insurance plans will not have much of an immediate effect on healthcare economics or the success of the Affordable Care Act, but if the tax continues to be pushed off and is essentially dead, consequences loom large. Congress announced the omnibus budget agreement and tax extenders bill late Tuesday with a vote planned before the end of the week. White House officials have indicated the president will sign the package into law.

It includes delaying for two years implementation of the “Cadillac” tax, which was scheduled to go into effect in 2018. It also freezes the medical-device tax that began in 2013 for two years and delays the annual tax on health insurers by one year.

The Cadillac tax is 40% of the value of employer-sponsored plans that exceed certain thresholds: $10,200 for individual coverage and $27,500 for family coverage.

An August report from the Kaiser Family Foundation estimated that about a quarter of businesses would be subject to the tax in its first year, increasing to 42% by 2028.

Source: Shannon Muchmore, Modern Healthcare [12/16/15]

LikeLike

Don’t Repeal the Cadillac Plan Tax – Replace It

Beginning in 2018, high-cost, private sector health plans will be subject to a special levy, popularly known as the “Cadillac plan” tax.

http://thehealthcareblog.com/blog/2015/08/30/dont-repeal-the-cadillac-plan-tax-replace-it/

Under a provision of the Affordable Care Act, health plans must pay a tax equal to 40 percent of each employee’s health benefits to the extent they exceed $10,200 for individual coverage and $27,500 for family coverage.

So, can it be replaced?

Ann Miller RN MHA

LikeLike

Penalties Rise for Failing to Sign Up for Health Insurance

Americans without health insurance will face stiffer tax penalties and other sanctions in 2016 for failing to sign up for coverage under the Patient Protection and Affordable Care Act, The Fiscal Times recently reported.

Compared to this year’s average household penalty of $661 for not carrying health insurance despite enrollment eligibility, the average fine in 2016 is estimated to increase 47% to $969, according to the article, which cited information provided by the Kaiser Family Foundation.

Broken down by subsidy eligibility status, the average 2016 penalty for not signing up is estimated to run $738 for people eligible for marketplace subsidies and $1450 for people ineligible for subsidies.

Source: First Report Managed Care

LikeLike

ACA Slamming UHC?

UnitedHealth Group warned nearly two months ago that new customers from the Affordable Care Act exchanges would hurt the insurer’s bottom line, but it looks like it misestimated by how much as enrollments exceeded expectations.

http://www.msn.com/en-us/money/companies/unitedhealth-says-obamacare-is-costing-it-billions/ar-BBou9kc?li=BBnb7Kv&ocid=U348DHP

George

LikeLike

The Fate Of The So-Called Cadillac Tax

More than half (61%) of employers surveyed for a 2015 Healthcare Trends Institute study said they had made no changes to their 2016 benefit plans in advance of the tax.

Another 24% indicated that although they hadn’t made any changes to 2016 plans, they expect to do so in 2017.

Only 10% have actually made concrete plans to to avoid the tax, while just 8% have already adjusted their plans to sidestep the ACA levy.

Source: Employee Benefit News

LikeLike

Cadillac Tax postponed

The Cadillac tax has been postponed until 2020.

In fact, in the Senate, a 90-10 bipartisan majority actually voted to kill the tax outright, strongly suggesting that strong opposition from unions and large employers will prevent the tax from ever being levied.

And, presumptive Democratic nominee Hillary Clinton has announced her support for killing the tax.

Willow

LikeLike

UPDATE

The stopgap spending deal just reached by Congress suspended imposition of the so-called Cadillac tax on high-value health plans, a 2.3 percent tax on medical devices, as well as the health insurance tax.

https://www.msn.com/en-us/money/healthcare/obamacare-taxes-suspended-in-deal-to-end-federal-shutdown/ar-AAv4Qiw?li=BBnbfcN

Dr. David Marcinko MBA

LikeLike